TAX ALERT 2020/02

19-03-2020

COVID-19 Gifts/Update

On 17 March 2020 Law Decree of 17 March 2020, no. 18 (the "Decree") was published in the Official Gazette of the Italian Republic (General Series no. 70) containing measures to strengthen the national health service and support economically families, workers and businesses in relation to the COVID-19 epidemiological emergency. As an integration to our previous Tax Alert 2020/1, we note that art. 66 of the Decree introduces some specific tax benefits for gifts made for the support of the containment of the disease.

Specifically, the following tax benefits are introduced:

- for individuals and non-commercial entities, a tax credit - up to EUR 30,000 - for an amount equal to 30% of the gifts in cash and in kind made in 2020 to the State, to Regions, to territorial local bodies, to public bodies or institutions, to foundations and to legally recognized non-profit organizations aimed at financing actions for the containment and the management of the epidemiological emergency caused by the COVID-19 outbreak;

- for business taxpayers, with a cross-reference to art. 27 of the Law of 13 May 1999, No. 133, a tax allowance consisting of the full deductibility from business income of gifts in cash and in kind made in2020 aimed at supporting the measures to combat the ongoing epidemiological emergency. The beneficiaries of the gifts referred to by Law No. 133/1999, are those listed in the Decree of the President of the Council of 20 June 2000 which mentions: (a) the State, regional and local public administrations, non-economic public entities; (b) recognized non-profit organizations (ONLUS); (c) foundations, associations, committees or institutions (set up by public deed or registered deed) having the aim to assist population hit by calamities or extraordinary events; (d) labor unions or professional associations. The aforementioned gifts are deductible - on a cash basis - also for the purposes of regional tax on productive activities (IRAP). The 1999 provision also establishes that the gift of goods made to the above entities does not constitute an assignment to a non-commercial use of the goods, so that the transfer shall not generate taxable revenues and capital gains and that the gifts are not subject to gift tax.

From the analysis of the Governmental and Technical reports to the Decree one should conclude that the newly enacted tax benefits are added to those already available and that have been already described in our Tax Alert 2020/1.

As regards in-kind gifts, art. 66 of the Decree provides that for the purpose of determining their value for tax purposes, following Articles 3 and 4 of the Decree of the Ministry for Economic Development and Social Policies of 28 November 2019 (the “DM”), the following principles applies:

- for individuals and non-commercial entities:

- in-kind gifts are valued on the basis of the normal value (i.e. market value);

- if the value exceeds EUR 30,000 or cannot be determined by objective criteria due to the nature of the gifted goods, the person making the gift must obtain a sworn appraisal. The sworn report, which must be dated not earlier than ninety days from the gift, must be delivered to the beneficiary;

- for business income taxpayers:

- for capital assets, the amount of the tax benefit is determined with reference to the residual tax basis of the assets on the transfer date;

- for goods, whose production or trade falls within the entity’s activity, for raw materials, subsidiary materials and semi-finished products purchased for use in production, the gift must be valued at the lower of the normal value and that determined by applying the provisions of art. 92 of the Income Tax Code on the valuation of inventories.

The DM also provides that in-kind gifts, irrespective of who the grantor is, must be proved by means of a written document containing: (i) the statement of the person making the gift which contains the analytical description of the gifted goods together with the indication of their values; (ii) the statement of the beneficiary showing the commitment to directly use the goods for the performance of the specific activity supported (which, in this case, is the management, containment or combat of COVID-19).

It is worth mentioning that the new legislation could be subject to amend-ments/integration during the conversion procedure.

It is worth mentioning that the new legislation could be subject to amend-ments/integration during the conversion procedure.

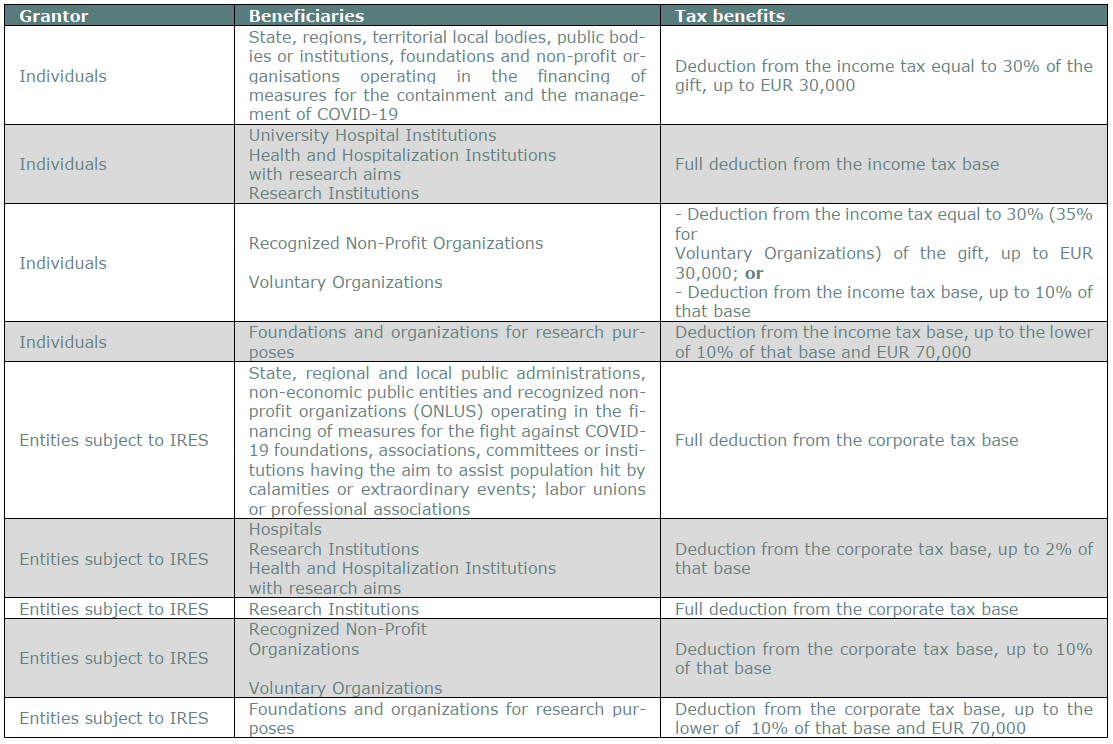

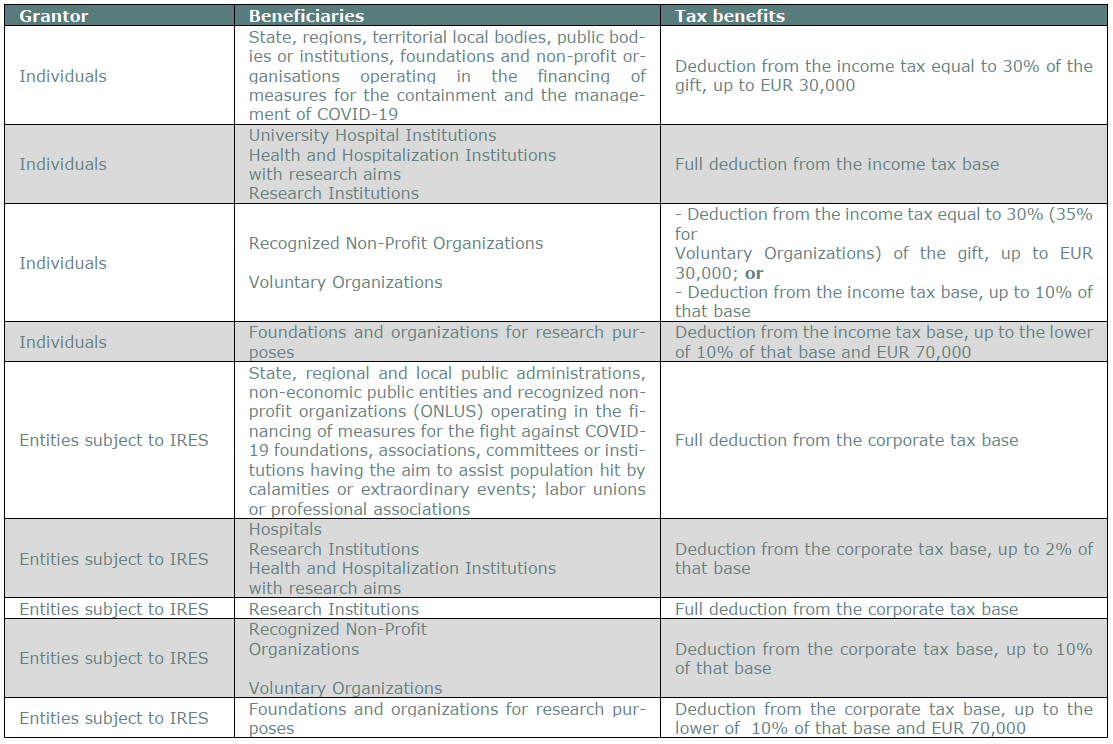

For the benefit of those who are willing to make gifts to entities operating on the front line in the management, containment or fight against COVID-19 we add below an updated table which shows the tax benefits currently in force. We remain available to provide the appropriate clarifications in each specific case.